extended child tax credit 2022

Lawmakers increased the benefit from 2000 per child per year to a maximum of 3600 per child 5 or younger and 3000 for kids 6-17. Congress let it expire.

Will The Monthly Child Tax Credit Payment Be Extended Next Year The Us Sun

How the Extended Child Tax Credit Could Make a Comeback.

. The legislation made the existing 2000. Tax deadline extended. Child tax credit 2022.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. The American households should have gotten up to 1800 per child in Decembers payment. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

The number of children living in. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of. 2022 FFN Game of the Week.

The American Rescue Plan was passed in Congress in 2021 with this increasing the amount that eligible American families could receive from their Child Tax Credit payments. In January the Biden administrations one-year expansion of the child tax credit CTC program expired after. 2 days agoParents of children likely recall the expanded child tax credit quite well.

Families could qualify for up to 3000 per child between ages 6 and 17 and 3600 per child under 6 and receive half of the sum before actually filing their taxes. In 2017 this amount was. Because the enhanced child tax credit was not extended by lawmakers millions of taxpaying American parents will see the federal credit revert back to.

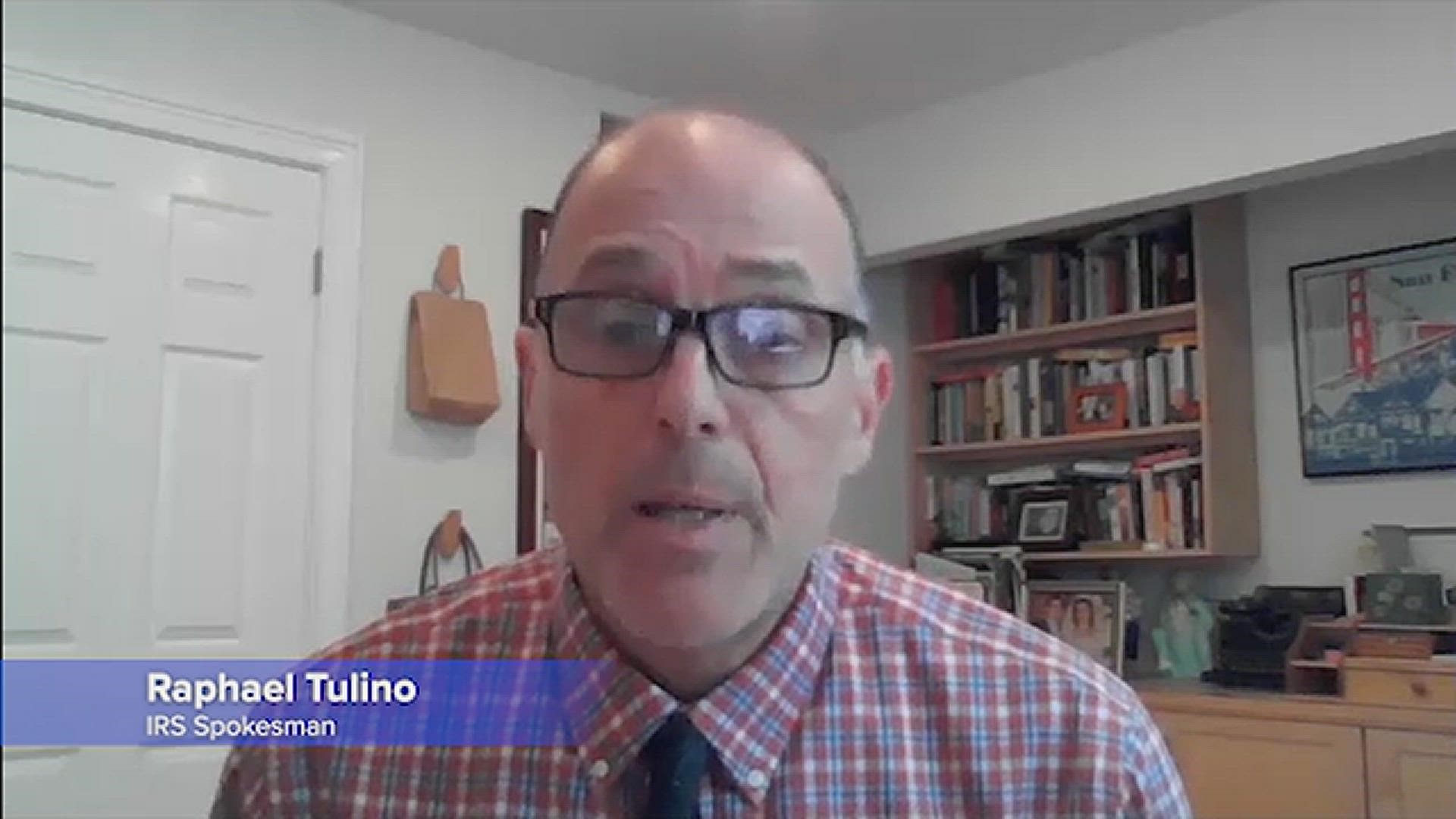

IRS wants millions to claim child tax credit stimulus funds. The EITC is generally available to workers without qualifying children who are at least 19 years old with earned income below 21430 for those filing single and 27380 for. However if parents alternate claiming each year both parents may receive the child tax credit this year.

Analysis from Columbia University suggests that 34 million more children lived in poverty in February 2022 compared with December 2021. Sorting out those issues will be key if the federal government ever revives the program of sending partial tax credits to families as monthly payments. The Child Tax Credit is a federal tax credit that reduces the amount of federal taxes owed by a taxpayer by 1000 for each child under age 17.

The child tax credit was temporarily expanded for 2021 under the American Rescue Plan Act passed by Congress in March 2021. That means eligible families will be able to claim the remaining 1800 in their tax. March 16 2022 Many Americans save their tax refund or use it to chip away at debt but advance payments of the Child Tax Credit in late 2021 filled a.

The expanded Child Tax Credit was worth 3000 for children ages 6 to 17 and 3600 for children under 6 in 2021. These payments were part of the American Rescue. The maximum child tax credit amount will decrease in 2022.

For many families that meant six. Government disbursed more than 15 billion of monthly child tax credit payments in July to American families. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021 it could substantially reduce child poverty in the vast majority of US.

By Region 8 Newsdesk. It was a program created in 2021 that only lasted for that calendar year. As part of the American Rescue Act signed into law by President Joe Biden in.

Have been a US. Families only received half so they are waiting to receive the other half this.

Parents Guide To The Child Tax Credit Nextadvisor With Time

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

What Families Need To Know About The Ctc In 2022 Clasp

Will Monthly Child Tax Credit Be Extended Into 2022 Motherly

Child Tax Credit Here S What To Know For 2022 Bankrate

Documenting Covid 19 Employment Tax Credits

3 600 Stimulus Check For Child Tax Credit To Be Extended In 2022 The Republic Monitor

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

Child Tax Credit 2022 Monthly Payment Still Uncertain 11alive Com

/child-tax-credit-4199453-FINAL-bc961c42d9a74cbda93039d360debeec.png)

Child Tax Credit Definition How It Works And How To Claim It

Child Tax Credit 2022 Extension Update Is It In The Biden Plan Wfaa Com

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

Will Monthly Child Tax Credit Payments Be Renewed Forbes Advisor

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

/cdn.vox-cdn.com/uploads/chorus_asset/file/23423371/GettyImages_1328589075.jpg)

Will There Be An Expanded Child Tax Credit In 2022 Vox

Child Tax Credit Payments The Pros And Cons Of A New Republican Plan

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Is The Enhanced Child Tax Credit Getting Extended This Year Here S The Latest Cnet

I M Not Giving Up Sen Michael Bennet S Drive To Make The Expanded Child Tax Credit Permanent Colorado Public Radio